“No one in this world, so far as I know … has ever lost money by underestimating the intelligence of the great masses of the plain people.”

H. L. Mencken

Notes on Journalism

(September 19, 1926)

March 11 2024 — Many years ago, while researching the Havana Syndrome affair, I noticed serious ‘issues’ regarding Proximus, the main Belgian Telecom Operator, which is owned primarily by the State (53%). Thus, I issued a simple recommendation to Proximus shareholders: “Sell all your shares of Proximus!” I was not wrong. Follow us on Twitter: @INTEL_TODAY

RELATED POST : Five Years Ago — And thus a new syndrome was born… (Havana Syndrome – October 3 2017) [UPDATE : A Conversation with Nicky Woolf]

“Sell all your shares of Proximus today! Soon, these shares won’t be worth more than toilet paper.”

Intel Today

(May 1st 2020)

In the quarterly update of the Bel 20, the blue-chip stock index in Belgium, stock market operator Euronext dropped Proximus, which is replaced by Lotus Bakeries, effective March 18, 2024.

Proximus has figured in the Bel 20 since 2004. The decision is based on trading volumes and market capitalization which eroded sharply, from EUR 8.24 billion at the end of 2019 to about EUR 2.6 billion.

The shares of Proximus have lost about 80% of their value. The Belgian State owns 180,887,569 shares of Proximus out of 338,025,135. This lost amounts to more than a staggering 4 EUR billion. That mistake will be a major difficulty for the next government.

And during all these years, Belgian federal minister Petra De Sutter [GREEN Party] repeatedly stated that the Belgian State must remain in control of Proximus.

H. L. Mencken and others have long contended that it’s safe to bet on the stupidity of the great masses. While that may hold some truth, betting against the laws of physics is not a gamble; it’s suicide.

The Belgian government opted for an imprudent strategy, and when it inevitably failed, these politicians chose to double down.

Now, every citizen will bear the consequences. This story is far from over. Stay tuned – it’s a saga that unfolds beyond the ordinary, where the stakes are high, and the repercussions are yet to fully reveal themselves.

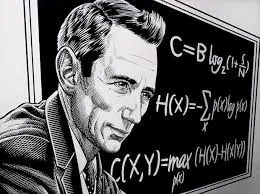

Once again, this fiasco could have been easily avoided by engaging real experts who understand Shannon’s theory of information and communication. It was plain obvious!

REFERENCES

Proximus demoted to midcap index after share price fall — Telecompaper

=

Havana Syndrome: The Cost of Ignorance [Proximus demoted from BEL20]

“The first method for estimating the intelligence of a ruler is to look at the men he has around him.”

Niccolo Machiavelli